Navigating taxes can feel overwhelming, especially for business owners. When you consider business tax preparation in San Bernardino, partnering with a tax firm offers relief. You can focus on what you do best while experts manage your taxes. First, partnering with a tax firm saves you time. Handling taxes on your own pulls you away from core tasks. Second, it reduces the risk of costly errors. Tax professionals know the latest rules, ensuring correct filings and accurate deductions. Mistakes can lead to penalties, but with expert guidance, you avoid these risks. Third, expert advice helps you maximize savings. Tax firms pinpoint opportunities for deductions and credits. This means more money stays in your business. Each of these benefits contributes to smoother operations and peace of mind. Letting experts manage your taxes ensures you stay compliant and optimize your financial situation.

Saving Time

Time is precious. When you run a business, every minute counts. By hiring a tax firm, you delegate complex tasks to professionals. This frees up your schedule for other business activities. Moreover, tax laws change frequently. Keeping up with these updates is time-consuming. Tax firms stay current and handle these changes for you. According to the IRS, tax professionals can help you meet deadlines and avoid last-minute rushes. This reduces stress and allows you to focus on growth. Efficient time management by experts gives you peace of mind and boosts productivity.

Reducing Errors

Errors in tax filings can be costly. Incorrect information might lead to penalties or audits. Tax professionals have extensive training in tax codes and regulations. This helps prevent mistakes. Their expertise ensures that your filings are accurate. They double-check documents, minimizing errors. According to a study by the Urban Institute, businesses that use tax firms experience fewer audit issues. This means fewer headaches and potential savings. With experts handling your taxes, you can trust that your filings are correct and compliant.

Maximizing Savings

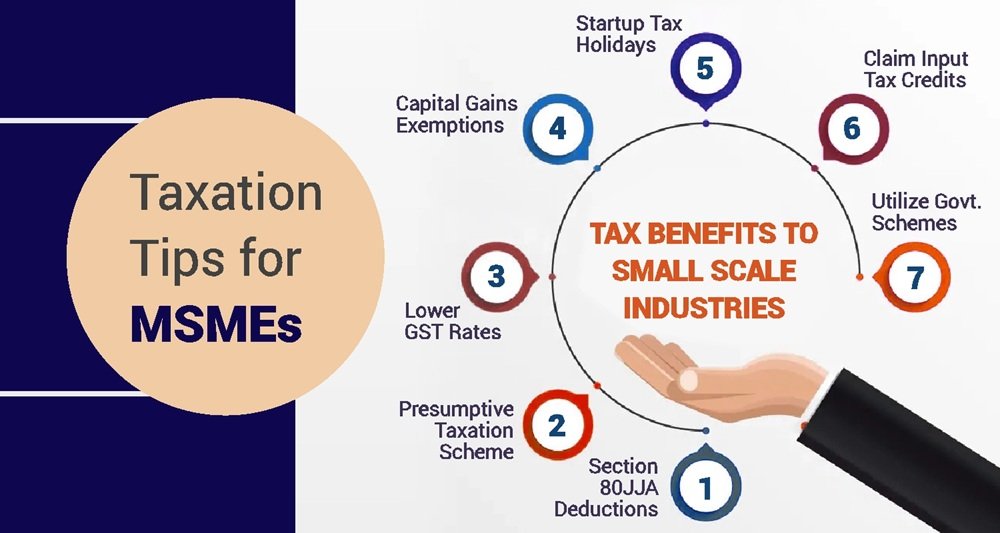

Tax firms not only prevent errors but also find ways to save you money. They identify deductions and credits you might miss on your own. These savings can add up significantly. Tax experts understand how to optimize your returns legally. For example, they know the best ways to handle depreciation or capital gains. This means more money stays in your pocket. By uncovering tax-saving opportunities, tax firms enhance your financial health and ensure you’re not overpaying.

Comparison: Handling Taxes Alone vs. Hiring a Tax Firm

| Aspect | Handling Taxes Alone | Hiring a Tax Firm |

|---|---|---|

| Time Investment | High | Low |

| Risk of Errors | High | Low |

| Cost Savings | Potentially Low | Potentially High |

| Compliance | Variable | Consistent |

Conclusion

Partnering with a tax firm transforms how you manage taxes. You save time, reduce risks, and increase savings. Trusting professionals with your tax needs allows you to focus on business growth. The benefits of using a tax firm are clear. You gain peace of mind knowing experts handle your taxes accurately and efficiently. The advantages of time management, error prevention, and financial optimization enhance your business operations. As you consider business tax preparation in San Bernardino, remember the value a tax firm brings. The investment in professional tax services pays off in time, accuracy, and savings.