Accounting firms play a crucial role in helping businesses plan for the future. They act as trusted advisors, guiding you through the maze of financial forecasting. You gain clear insight into your financial future. This insight allows you to make informed decisions that can safeguard your company’s longevity. Accounting experts provide a roadmap, ensuring your financial goals are not just dreams but attainable realities. They simplify complex numbers, highlighting the financial health of your business. You can trust them to manage nuances like business tax preparation in Westchester, ensuring compliance and efficiency. Their expertise helps you avoid costly mistakes, ensuring a smoother path forward. When you partner with an accounting firm, you invest in your business’s future. They guide your steps, offering knowledge and precision. With their support, you confidently face financial challenges. The journey might be daunting, but you never walk alone. Your success becomes their mission.

The Role of Accounting Firms

Accounting firms provide foundational support that is essential for businesses aiming to thrive. They bring a wealth of experience and in-depth understanding of financial trends. By analyzing data, they help you prepare for both opportunities and pitfalls. Their role extends beyond number crunching. They facilitate strategic planning and offer fresh perspectives on financial health.

Key Benefits of Financial Forecasting

- Risk Management: You anticipate potential challenges.

- Capital Management: You make educated decisions about investments.

- Strategic Planning: You align goals with actionable steps.

These elements form the backbone of successful financial forecasting. By understanding these benefits, you can better navigate the business landscape with confidence.

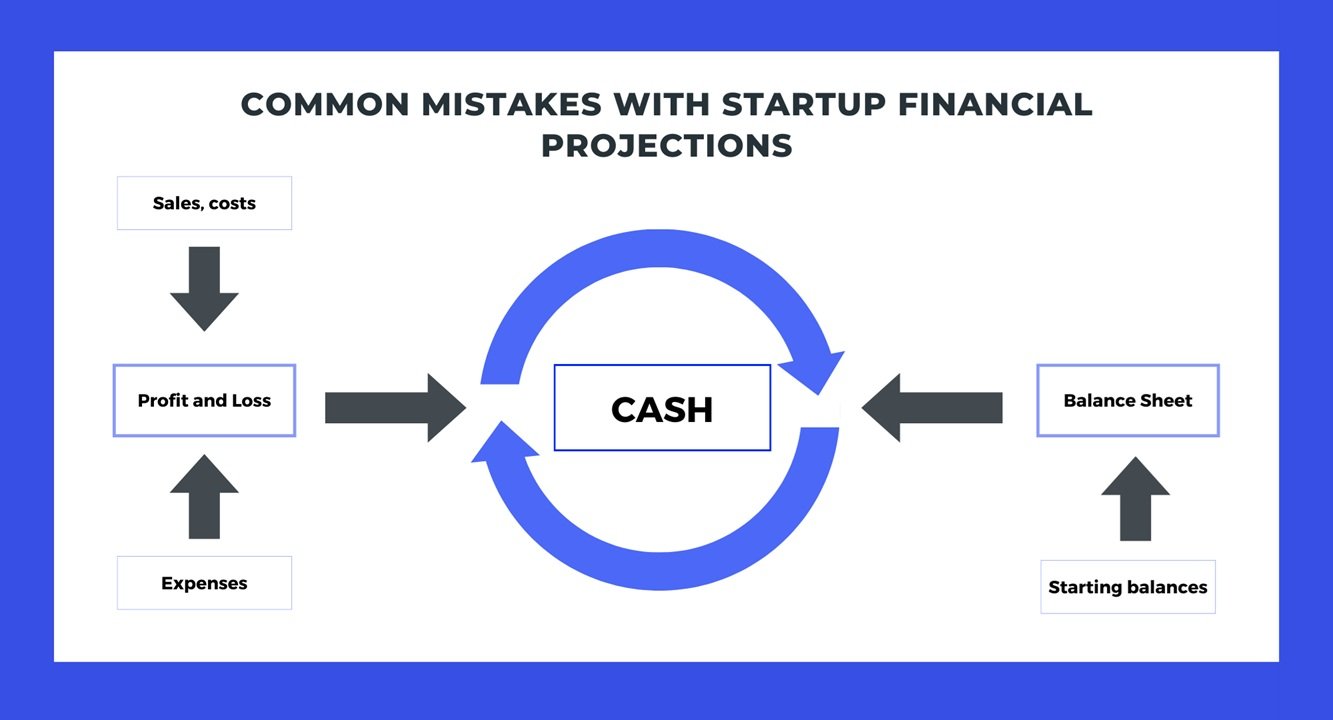

How Forecasting Works

Financial forecasting involves estimating future financial outcomes based on past and present data. This process requires an understanding of market trends and internal business metrics. Here’s a simplified comparison of statistical methods used in forecasting:

| Method | Description |

|---|---|

| Qualitative | Relies on expert judgment rather than numerical data. |

| Quantitative | Uses historical data and mathematical models. |

Qualitative methods are useful when data is limited. Quantitative methods provide structure and rely heavily on data accuracy.

Collaborating with Accounting Firms

Collaboration with an accounting firm can provide insights beyond the numbers. They identify trends and help interpret data to make actionable decisions. This partnership empowers you to face financial uncertainties with informed strategies.

Case Study Example

Consider a small business in Westchester navigating seasonal sales fluctuations. By collaborating with an accounting firm, they use historical sales data to predict peak sales periods. The firm provides expertise in business tax preparation, allowing the business to allocate resources efficiently. This partnership results in improved cash flow and strategic investment decisions.

Compliance and Efficiency

Accounting firms ensure that your business complies with financial regulations. They help in preparing necessary documents and reports, reducing errors and penalties. Efficient processes save time and resources, allowing you to focus on business growth.

Conclusion

The expertise of accounting firms is invaluable in the realm of financial forecasting. Their support offers peace of mind and clarity. By choosing the right partner, you can navigate the future with confidence. For more insights on financial management, visit IRS – Businesses or consult Small Business Administration for resources tailored to your needs.

In conclusion, accounting firms do more than manage numbers. They empower your business journey, providing the tools you need to achieve and sustain success.